Explore your funding opportunities now:

When do you need the finance?

Before a disaster

After a disaster

The severity and frequency of natural disasters necessitates member countries to prepare, respond and recover from these catastrophes. The strategic response requires tailored support to build financial resilience. There is a plethora of financial instruments already in existence. However, member countries face challenges to access this information in a structured manner.

The Commonwealth Disaster Risk Finance Portal therefore simplifies access to this information through a ‘one-stop-shop’ model. The portal is a repository of information on a range of finance instruments available to help member countries manage the financial impact of natural disasters.

The ferocity of disasters has resulted in an escalation of global efforts to support countries’ enhancement of their financial resilience and protection. International finance institutions and other stakeholders increased disaster risk financing and insurance solutions to countries particularly vulnerable to climate shocks.

Therefore, disaster risk finance is the process of developing and implementing a credible financing strategy and systems to provide financial protection and increase countries’ resilience against natural disasters.

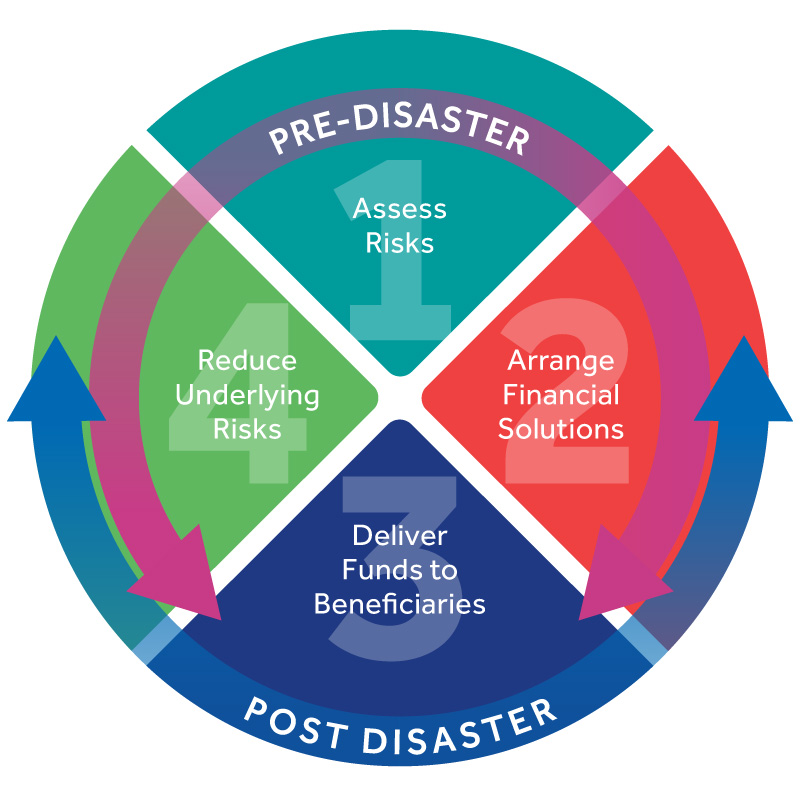

Operationally, there are core technical steps to be undertaken in developing disaster risk finance strategy outlined as follows:

Financial resilience is one of the pillars of a comprehensive approach to mitigate the impact of disasters. This includes provision of pre-arranged or an emergency funding to protect governments, households and businesses.

In order to determine and decide on appropriate funding mechanisms/instruments, there is a need to have risk information to assess underlying price of disaster risk, costs and benefits; ascertain risk ownership and cost of capital. Additionally, choice of funding mechanism/instruments is reliant on timeliness of funding and discipline in planning.

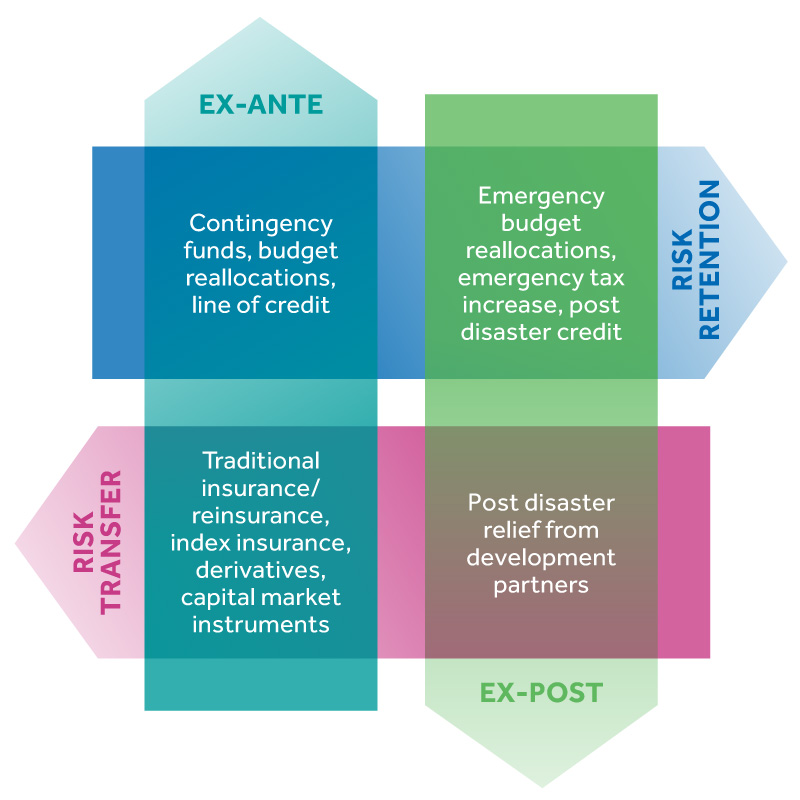

Depending on the financial impact, finance instruments can be pre-arranged (triggered before a disaster) or post-arranged (triggered after a disaster). In addition, governments can own risk or transfer risk to a third party through insurance.

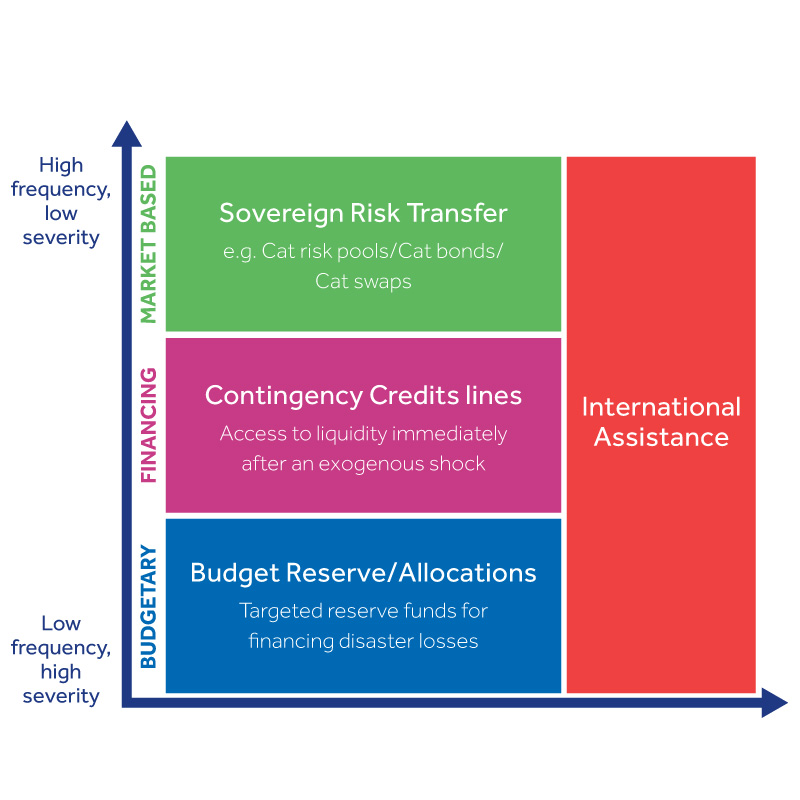

However, no single risk finance instrument can address all the risk ranging from small-scale to catastrophic events. As a result, risk layering is the cost-effective way of disaster financing through a combination of disaster risk finance instruments aimed at addressing different layers of risk.

The glossary provides definitions of concepts and terms used in the disaster risk finance sphere.

View Glossary